Printable Hourly to Salary Chart

Knowing the conversion, from hourly to salary pay rates can be important, especially for planning your personal finances. This free printable hourly to salary chart can help you with the conversion, and a quick reference guide. It’s always beneficial to know approximately how much you will bring in each year for hourly employees, but also if you are being promoted from an hourly employee to a salaried employee.

Please note, before we dive into this conversion chart, it’s important to point out that this is provided for informational purposes only. Your financial data may be slightly different depending on your specific employer, as well as your local taxes and withholdings.

Gross Pay vs Net Pay

Before we jump right into the details of your hourly-to-salary conversion chart, it is important to first point out that this chart is given in gross pay, which is before all of your taxes and withholdings. The net income, or your take-home pay will be slightly different depending on the taxes, and other withholdings that come out of your paycheck.

This means that the conversion chart can be used as a guide or reference, but you will not want to plan all of your personal finances around these numbers, because they are not your take-home pay. The amount you receive in your paycheck will be less than the numbers outlined in the chart.

Gross Pay: your income before any deductions. This is your total income, but the amount of pay you actually receive will be less after taxes and withholdings come out.

Net Income: your take-home pay, or in other words the money that comes directly to you after all of your taxes and other withholdings are deducted from your gross pay.

Hourly Rate

An hourly worker receives an hourly wage, which is based on the total number of hours they have worked. An example of this would be, suppose you received $20 per hour, and worked a 40-hour work week.

At the end of the week, your gross pay would be $800 ($20/hr X 40hrs) for that weekly pay period, but at the end of the week, the amount of money in your paycheck is going to be less, because this amount is before taxes and other withholdings.

Many jobs pay an hourly rate, and sometimes it even comes out to be a better deal, than if you are a salaried employee.

Annual Salary

An annual salary is usually designated for salaried employees. This means, the employer states in a given year they will give you a set gross pay. Now sometimes salaried employees receive a salary and then a commission on top of that, but most often companies pay a set amount of gross income to their employees each year, at a flat rate.

Typically, an annual salary will not change with how many hours are worked. An employee who works a salary job can put in 50 hours a week, but they may still get paid for the 40 hours that their salary is set at.

Although your salary may be set at a specific number for your gross pay, keep in mind, there will still be taxes and other withholdings that are taken from the set amount, before you receive your paycheck.

Other Factors

There are other factors that can also come into play, for both hourly and salary employees. If you are considering a new job, make sure to check out if any vacation time is included, as well as what your total salary or take-home pay would be after Social Security, federal government withholdings, and other different tax rates that come out of your paycheck.

Specifically for vacation time, if your employer says that you have two weeks of vacation each year that is paid, this is essentially like saying they are going to pay you for two extra weeks of the year, that you don’t have to work, which is definitely a perk.

Another benefit that is often overlooked is how much, if any, the employer will cover your insurance and other benefits. You will also want to be aware of how much money comes out of your paycheck each pay period for these withholdings.

Each employer and state sometimes calculate payroll taxes differently, so you will want to be sure to double-check to see what exactly your withholdings are so that you can correctly calculate your net pay or take-home pay.

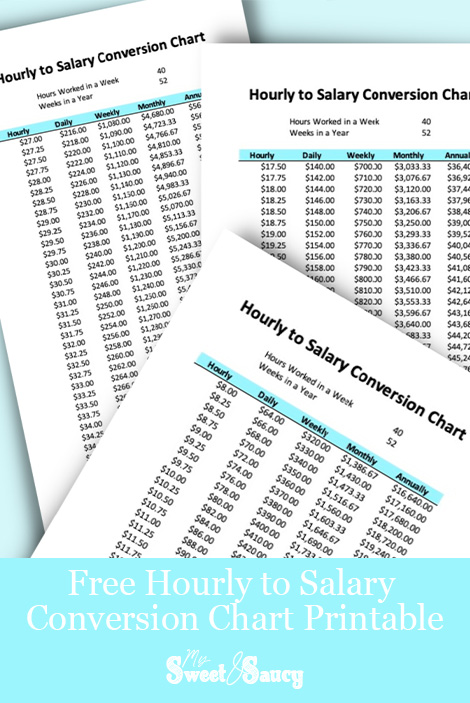

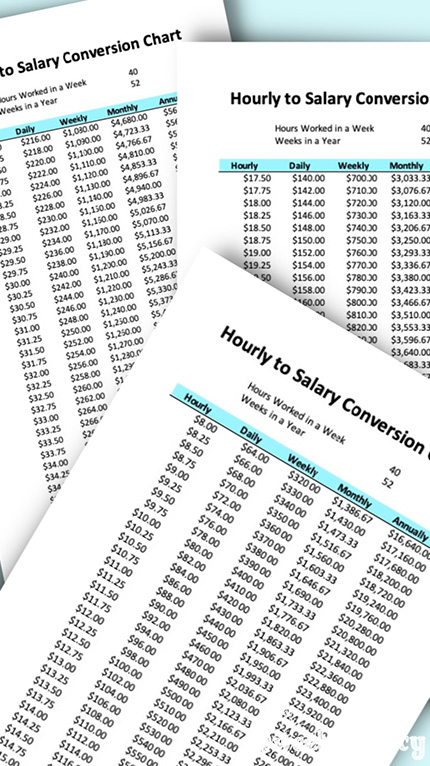

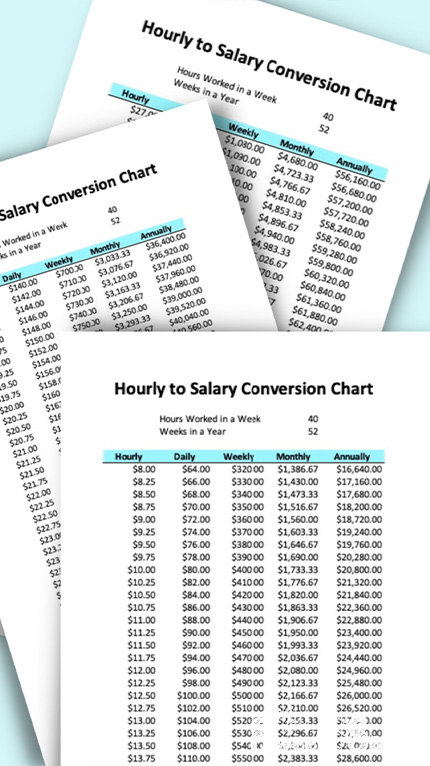

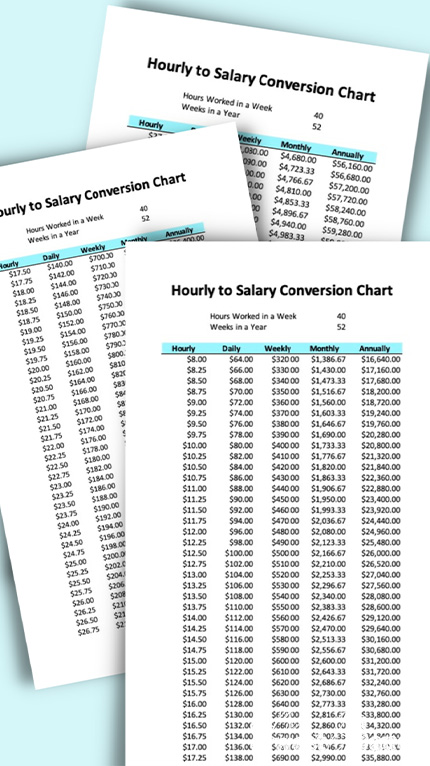

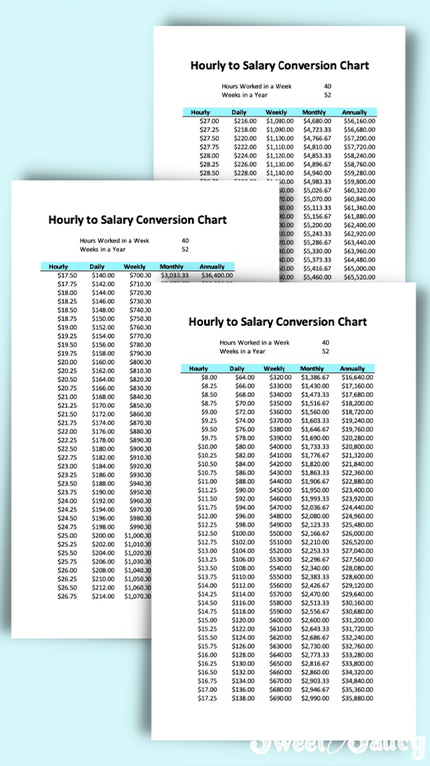

Printable Hourly to Salary Chart Free Version

This conversion chart estimates how much you are making before taxes and other withholdings come out of your paycheck. The conversion chart will also help you to estimate if moving from hourly to salary is going to be beneficial to you or not.

This free download comes as a PDF file, but in addition to the PDF format, I have also made available to you a paycheck calculator, which you can find in Microsoft Excel, or in Google Sheets. This will help you to customize your hourly to salary chart, with your specific hourly rate.

To receive your free download, please enter your email address in the box below, and a copy will be sent directly to your email inbox.

Please note that this principal hourly-to-salary chart is for your personal use only, it is not intended for commercial distribution. Please also remember that this is an estimate of your gross income, for details you will want to specifically speak with your human resources depart.

Here for Excel:

Here for PDF Version:

If You Have Specific Questions

If you have specific questions about your paycheck, and need a detailed explanation, you want to reach out to your human resources department. They will be able to advise you on your specific situation and give you specific details on what withholdings you have coming out of your paycheck.

The hourly to salary chart that I have provided here is simply for general guidance only and should not be used as legal advice. Please seek answers from your HR department, or alternative legal advice if you need it.

Printable Hourly to Salary Chart

This principal hourly-to-salary chart that I have created is intended to be used as a guide to help you estimate the conversion between your hourly pay rate and salary pay rate. This chart is intended for reference only, if you need details on your specific situation, then you will need to seek out the HR representative at your company. Also, remember that this hourly-to-salary chart represents the pay rate before taxes and other withholdings are taken out of the paycheck.

I hope that this reference guide has been helpful to you and that you understand how your salary or hourly pay rate converts. Make sure to take advantage of the free download, so that you can look back on it if needed.

Like this article? Be sure to follow us online for more like it! Find us on Pinterest, Facebook, Instagram, and YouTube.

PIN for Later!