Family Budget Template Printable

With this free family budget template printable, you can begin working your way toward any financial goals you and your family have been dreaming about. You don’t have to make much money in order to start using a monthly budget planner. No matter what the income level of your family, setting and sticking to a budget can be very beneficial!

These free budget printables will help you make the first step towards your goals, simply by coming up with a viable plan, writing it down, and trying to stick to your monthly budget sheet. After all, setting a plan for your finances is half the battle! The other half is following the plan that you set.

I have a background of working in accounting and finance before I took the leap to start this blog to share free and helpful resources with you. I have a strong passion for helping you set and meet your financial goals, no matter if they are personal goals or professional ones.

My hope is that you can use this free family budget template printable to set an achievable budget for your family, so that you will be able to stick with it to achieve your financial goals. Whether you are trying to get out of debt, grow a savings account, or plan for the future, it all starts by setting achievable financial goals with your family budget, and then sticking with the budget that you create.

Free Printable Budget Worksheet

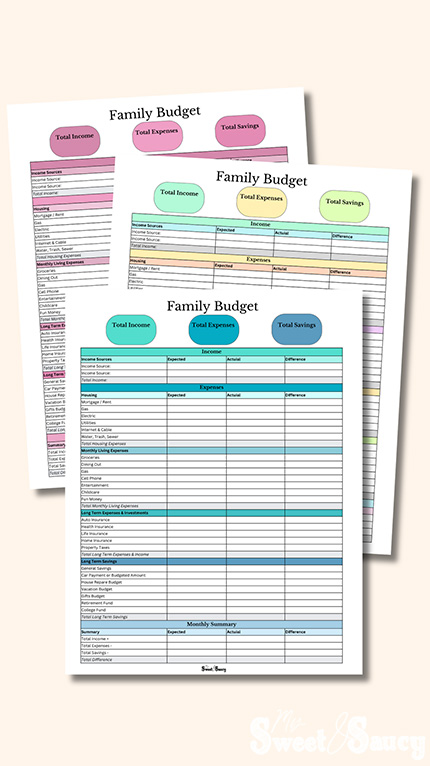

This free budget template is available to you, completely free of charge. You can download the template and print it off to use as many times as you wish. This family budget will help you balance your monthly income, with your monthly expenses, and track all your spending habits during the month so that they don’t exceed your total income gained during a given month.

Keeping track of your monthly income and expenses for the month will help you learn what happened during the month, and help you set goals for next month. You can also set estimates of how much you think will be spent on specific categories and compare them to what you spent during the month.

Tracking a family budget monthly is an easy way to budget. You can keep the budget on a monthly basis if you prefer. Using a monthly basis is often the easiest method for budgeting, because you can simply keep track of your total income and expenses for a given month, rolling whatever is left over to next month.

There are other budgeting periods that might also be useful for you, those are by paycheck and biweekly budgeting. When you budget by paycheck, you will want to account for all of your expenses that will be due during your pay period, whatever time frame that might be. You will also want to put aside money for larger bills that don’t occur as often. Biweekly budgeting is typically only needed for those who get paid every other week.

Often the easiest way to budget is by the month, and that is because most bills are owed on a monthly basis. Rather than basing the budget on your paycheck, you could determine how much you expect to get paid during the month and set your estimated budget on those amounts. Often this simplifies things when it comes to tracking your bills that are owed in a month.

The Budgeting Process

The budgeting process usually uses a monthly budget tracker and a savings tracker. Through this printable budget spreadsheet template, you can track all of your income and expenses in one of the easiest ways.

This printable budgeting worksheet has categories that you can customize for your personal use and adapt to fit your specific monthly bills. Then use the printable template throughout the month

Free Printable Monthly Budget Template

The main, broad budget categories of any budget template are going to be your family’s income, expenses, and any savings goals you might have. If you have debt, this could be in its own category, or included under your general expenses. The income section is where you will enter the estimated and actual amounts of money that you made during the month.

Then for expenses, from these larger categories, you will want to break the budget into different categories. These main categories might include things like car payments, mortgage payments, rent payments, and grocery bills.

You also might have other expense categories that are not the same amounts every month. These might be electric or other utility expenses. Some other items might include subscriptions you have, such as Netflix, Hulu, Prime, Hello Fresh, and Audible. No matter what your monthly expenses look like, make sure to break them down into specific categories for easier tracking.

Throughout the month, it is also important to remember to add money to your savings accounts if you are able. Make sure to set savings goals, even if it’s just a small amount. There are always things to save for, including vacations, home improvement, or starting a college fund.

Debt payoff is another expense category that you will want to remember to account for. If you are able to make more than the minimum payment of your debt, you will be able to pay it off much faster, to enjoy financial freedom. Dave Ramsey has all kinds of resources and suggestions for a debt snowball and debt payoff if you need a few more ideas on how to go about paying off your debt. Often it can be as simple as making extra principal payments on your debt whenever you are able. This will allow you to owe much less in the long run.

There is also a notes section on this family budget printable template. In this section, make sure to write down any notes you want to remember of things that happened during the month.

When you reach the end of the month, you can roll any ending balances, such as a savings account balance to the next month’s budget.

Remember, no matter what your financial situation, you can always begin to budget today, in order to achieve your financial goals down the road.

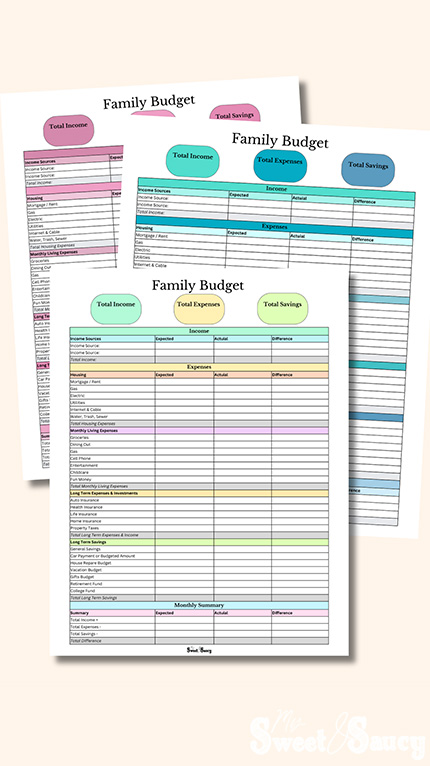

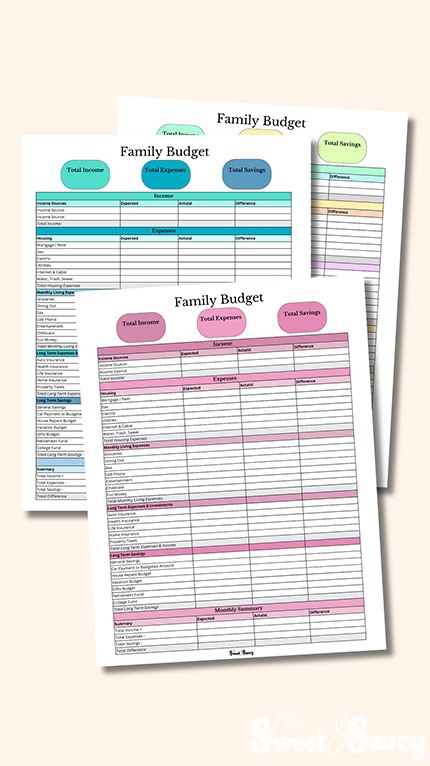

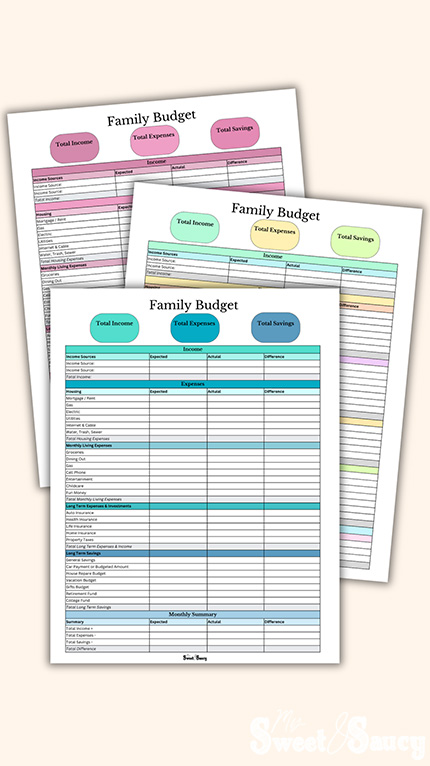

Fun Color Options

I have tried to make these family budget printable templates in different colors that are fun to use and look at. By using these monthly budget printables, to keep track of all of your income and expenses, you can take control of your finances so that you can sooner achieve any goals you might be dreaming of.

Printable Monthly Budget Worksheet

Here are a few money-saving tips that you will want to be sure to keep in mind as you begin your budgeting journey.

Set Specific Goals. When you are setting up your family budget, make sure that you set specific goals, and write them down on your budget template. It is said that you are much more likely to achieve your goals when they are specific and are written down.

Achievable Goals. When setting up your family budget, one of the keys to success is to make sure that your financial goals are achievable. Start with the basics of where you are currently, and make sure to set up a budget that you and stick with.

Stick With It. One of the keys to any goal is to stick to it. Hopefully, by using this free printable budget planner, you will be able to make a financial plan and stick with it each month.

Family Budget Worksheet

To get your free printable budget sheets, you will need to enter your email address into the box below, and a free copy will be sent directly to your email inbox. Please note that these files are prepared as a fillable PDF file. This means that you can enter your desired categories so that this budget planner template will work well for your family.

Please note that this file is created as a gift for you and is intended for your personal use only. This file should not be used commercially under any circumstances.

Using this budget template will help you keep track of your finances, and also help your family prepare a budget for family finances. Another great thing about this printable budget is that you can use it as a budget at a glance sheet, meaning that it gives you a quick overview of where your family stands financially.

How it Works

First, you will need to get your free copy of this family budget template printable. To do this, make sure to enter your email address into the box above. Once entered, check your inbox for an email from me.

Make sure to download the PDF file and save it to your computer or device. When you have the PDF opened, you can edit any of the category fields so that they fit your specific needs.

When you have your desired categories set, print out the PDF.

Set your estimated amounts for income and any expense categories. Use the printed family budget throughout the month to keep track of your actual income and expense amounts.

At the end of the month, use the current month’s budget to help you set up a budget for next month.

Tip: Also remember to set money aside each month for larger bills that might be due later in the year. Bills like property taxes, home insurance, and vehicle insurance are usually large amounts that you will need to save up for. It’s also a good idea to pay insurance amounts all at once if possible because many insurance companies give you a discount for doing this.

Household Budget Template

Using this free family budget planner is a great way to help you take hold of financial freedom for your household. The most important thing is to take advantage of this free budget worksheet download and get started making an achievable plan for your family’s finances today.

Thank you so much for stopping by to learn more about my free family budget template printable. I hope that you will take advantage of this free budget resource!

Like this article? Be sure to follow us online for more like it! Find us on Pinterest, Facebook, Instagram, and YouTube.

Make sure to check out free printables that might be of interest to you as well!

PIN for Later!